Now Available for All Members: New options for Member accounts!

Members can receive fraud alerts, by both text and email, for suspect debit/credit card transactions.

This is a great way to help keep your debit and credit card accounts secure! Members can now opt-in and opt-out through the online banking portal, It’s Me 247, through the app, or by replying to the initial text you receive. Please see images below for example texts, as well as an example email.

Members will receive an initial fraud alert text for any debit or credit card transaction that looks suspicious. If there is no confirmation by the member, then you would receive an alert email, and then finally, a follow-up phone call as a final line of defense.

NEW: MACO (Multiple Authentication Convenience Options) for the Mobile App now available to all Members.

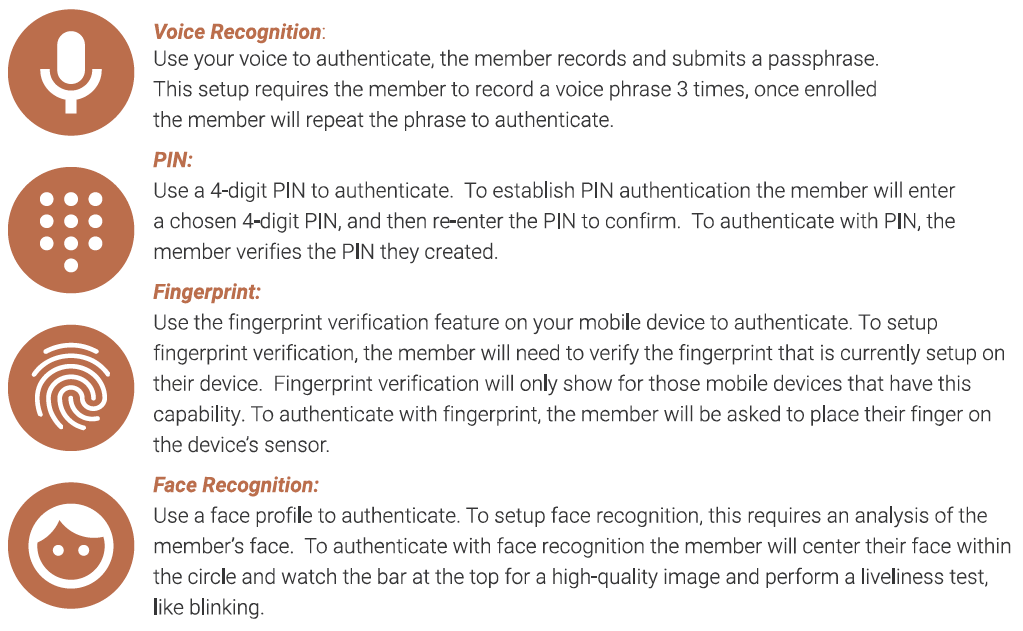

MACO features four different authentication types, including biometric and PIN-based. When a Member authenticates their account with any of these methods, they will have full access to their account on the Mobile app.

Available Authentication Options

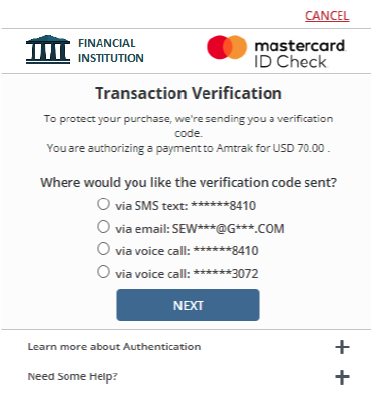

NEW: 3-D Secure for Online Transactions

All Members will be automatically enrolled in this new debit and credit card online transaction feature, which provides one more layer of security for your card accounts.

After the Member initiates an online transaction with their debit or credit card, additional authentication may be required with a One-Time Password (OTP). The OTP delivery methods displayed on the cardholder’s screen are based on the information on file for each cardholder: text, email or voice/call.

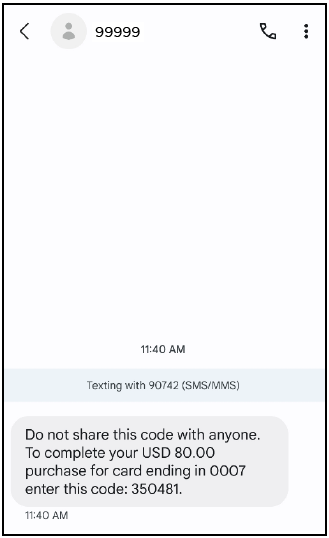

OTP Text Example

If the cardholder selects SMS text delivery, a text message is sent with the OTP. The cardholder can select Resend to send again, if needed. If Resend is selected within eight minutes of the previous request, the same OTP is sent. If the OTP expires and the cardholder selects Resend, a new OTP will be generated.

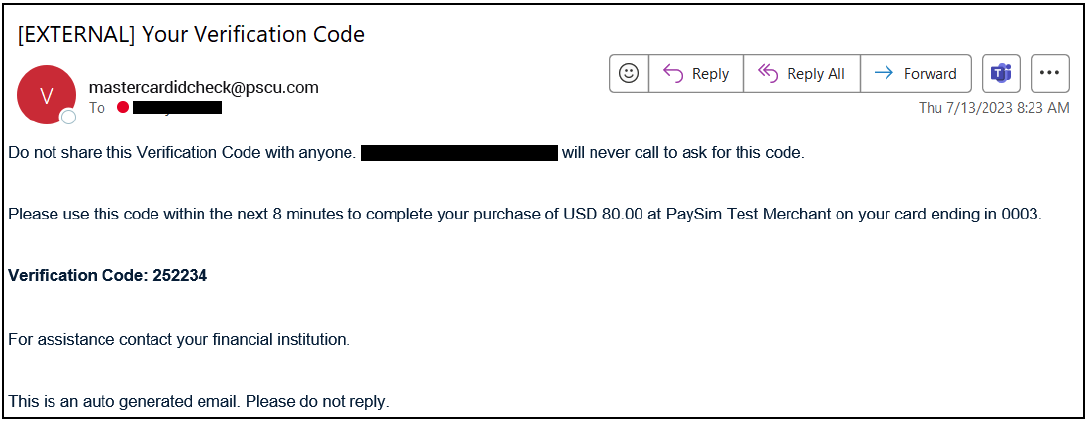

If email delivery is selected, an email is sent from: mastercardidcheck@pscu.com.

If the cardholder selects voice/call delivery, a phone call is generated to the phone number on file for the account.

Example message: Hello. Thank you for using our phone verification system. Your code is XXX. Once again, your code is XXX. Goodbye.

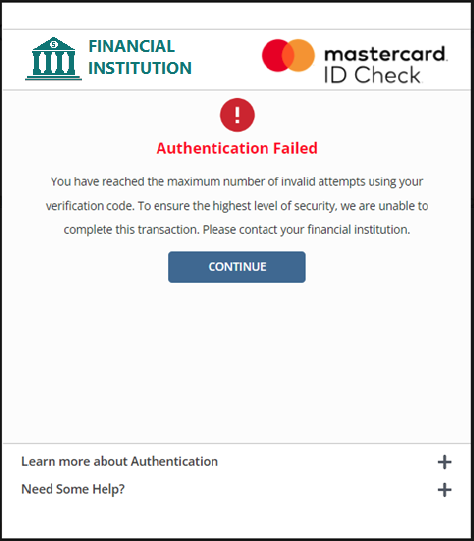

If the cardholder enters an incorrect OTP on three separate attempts, they receive an Authentication Failed screen and are directed to contact their financial institution.

OTP Failed Authentication Example